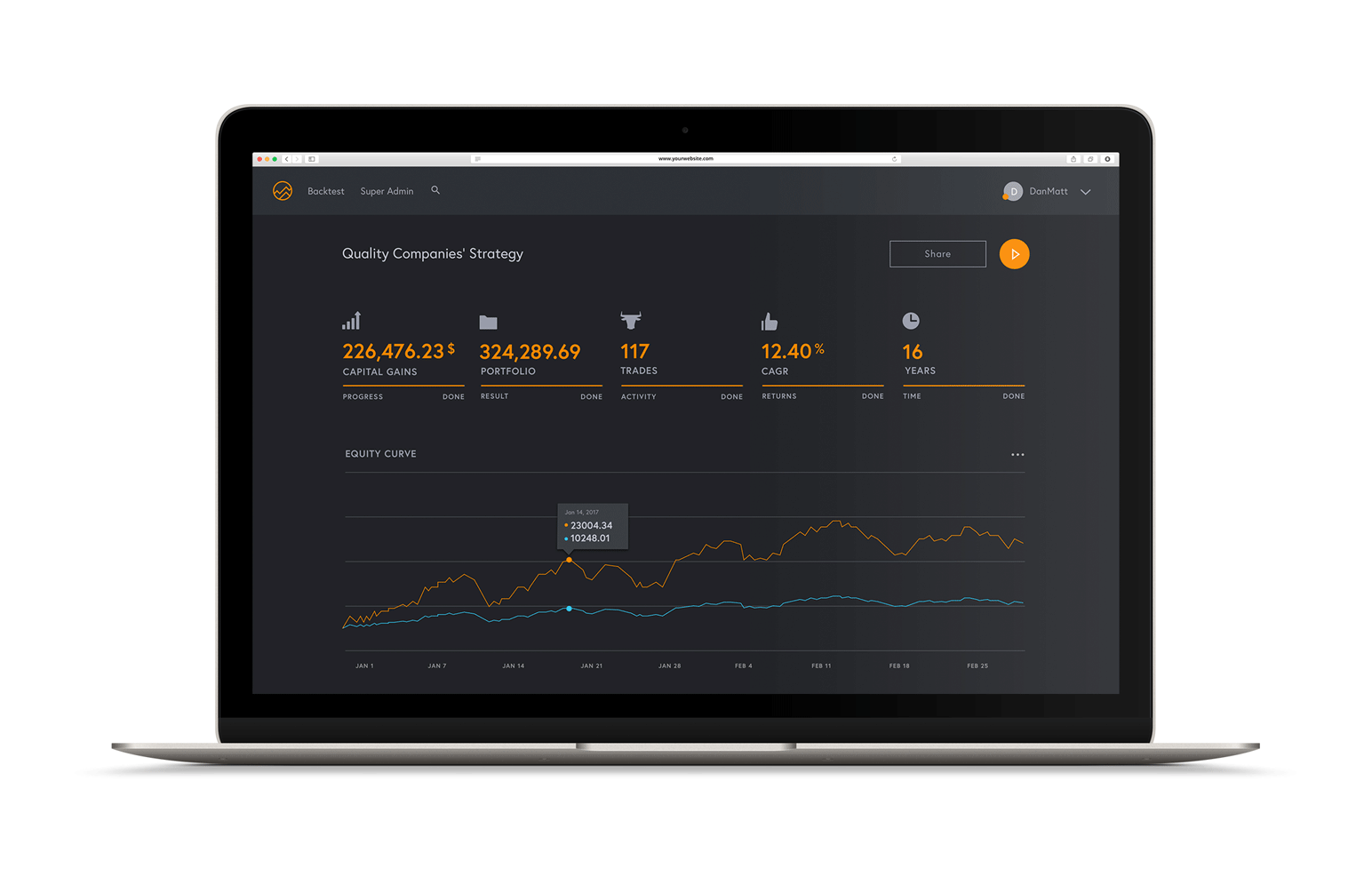

Improve your returns...

Improve returns by building and testing your own long-term investment strategies. Get portfolio specific, data-driven stocks each day, week or month.

Get started with Ready-To-Go fundamentals-based investment strategies running daily on the Australian and New Zealand stock markets.

Let us and your broker know if you want to automate your strategies.

Watch Video

Watch Video

Statistics