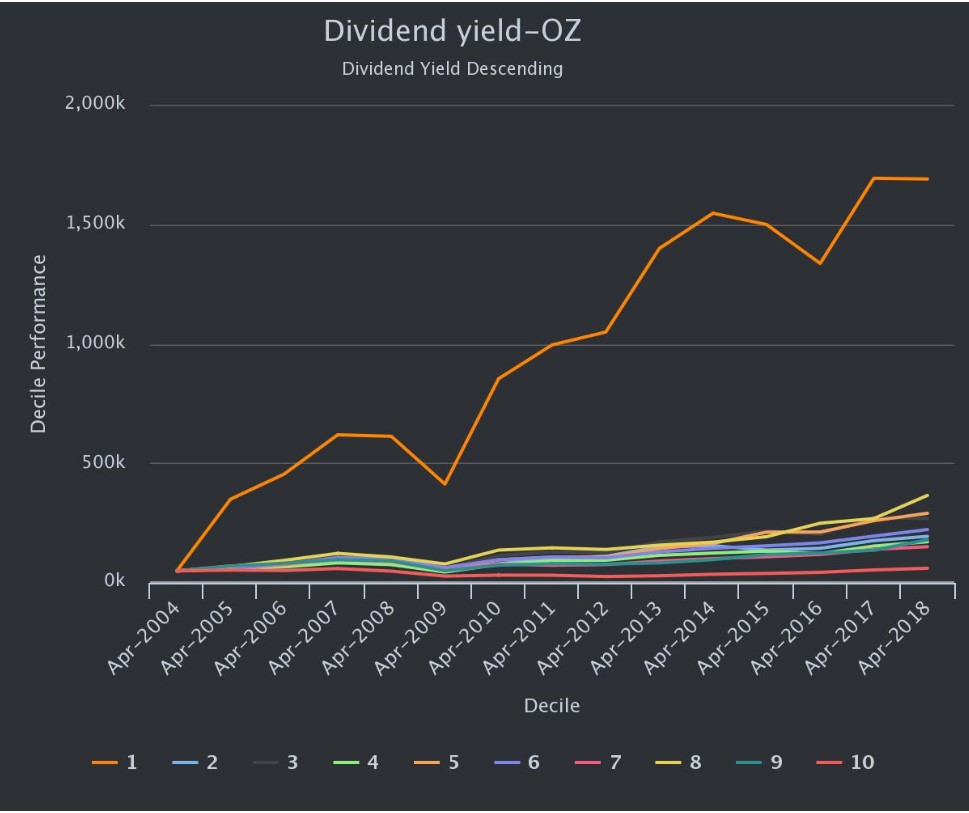

Yes, they do. The chart below splits the Australian stock market into deciles starting with those with the highest dividend yeild to the lowest. Our engine ranks all the companies listed on the ASX at that point in time and buys and sells those stocks in each decile each year. Decile 1 is the collection of stocks which have the highest dividend yields at that point in time.

You can see that decile 1 has substantially outperformed the rest of the market. This tells us that stocks with high dividend yields are more likely to outperform the rest of the market.

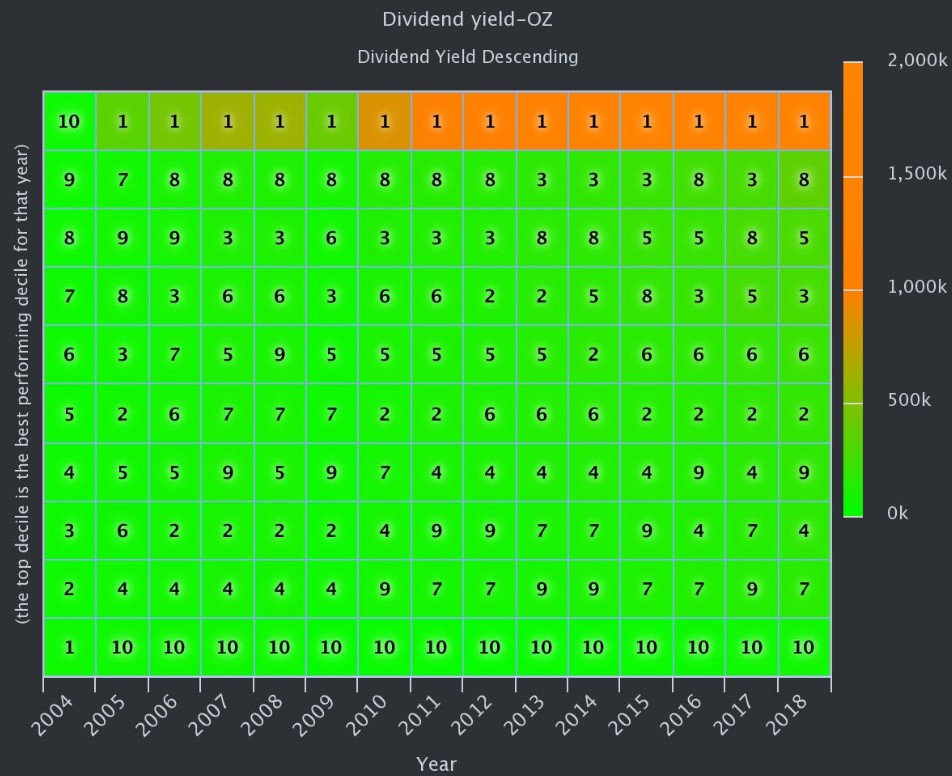

The heatmap below shows that while there is a tendency for high dividend stocks to outperform the rest, this is not always the case. Companies grouped in Decile 8 performed strongly from 2006 until 2012.

What does this mean?

If you’re building a portfolio with the intention of outperforming the ASX, you should consider dividend yield as a metric in your analysis.